triple bottom stock good or bad

In the year following a triple dip the SP 500 has gained 83 of the time by 148 on average Stovall says. The most basic PF sell signal is a Double Bottom Breakdown which occurs when an O-Column breaks below the low of the prior O-Column.

:max_bytes(150000):strip_icc()/dotdash_Final_Trading_Double_Tops_And_Double_Bottoms_Jun_2020-06-41d28d9e7b224ce48a224f328f139e76.jpg)

Trading Double Tops And Double Bottoms

Typically when the 3rd valley forms it.

. Triple bottom stock good or bad Monday March 14 2022 Edit. The only exception happened in the brutal 1974 market. Trades often consider this as a.

Understanding when institutional investors are accumulating a stock can. The volume is usually low during the second rally up and lesser during the formation of the. 2 Say a stocks price peaks at 119 pulls back to 110 rallies to 11925 pulls back to 111.

The formation of triple tops is rarer than that of double tops in the rising market trend. A triple bottom pattern consists of several candlesticks that form three valleys or support levels that are either equal or near equal height. For pattern traders the Triple Bottom pattern can.

The Triple Bottom Line is roughly the idea that corporations can and should measure performance not just according to the good-old-fashioned financial bottom line but. The Triple Bottom stock pattern is a reversal pattern made up of three equal lows followed by a breakout above resistance. Good For Bullish Breakouts.

From this basic pattern the bearish breakdown. Stocks usually keep heading lower when this happens. The Triple Bottom pattern is one of the most powerful chart patterns.

Triple Bottom is helpful to identify bearish stocks stock that have been trading weak. The only exception happened in the brutal 1974 market. The correction on the left side depends on what the market is doing but it generally should be 20-30.

DIXION - Triple top and Triple bottom. Follow The Simple Facts About Trading To Avoid Losses In The Forex Market Knowing The Basic Things Of Forex. Heres a triple dip you dont want.

The SP 500 fell in each of the first three months of the year. Triple tops are traded in essentially the same way as head and shoulders patterns. This could also indicate.

While this pattern can form over just a few months it is usually a. It can signal market bottoms tops and major reversals. The Candlestick pattern shows the 3 major support levels of a stock from.

If the major stock indexes correct 15-20 off their highs a 30. Basically the mindset behind the Triple Top Stock Pattern says that buyers are getting worn out or theyve lost the energy to push the price higher. The bottom line Bottom Line The bottom line refers to the net earnings or profit a company generates from its business operations in a particular accounting period that appears at the.

In the year following a triple dip the SP 500 has gained 83 of the time by 148 on average Stovall says.

Uber Picked A Bad Day To Go Public

The Best Stocks To Buy For The Bear Market And Beyond Fortune

Why Are The Stocks Of Companies Posting Quarterly Loss Rising While Of Those Posting Profits In This Quarter Are Declining In Context Of The Indian Stock Market Quora

:max_bytes(150000):strip_icc()/dotdash_Final_How_to_Trade_the_Head_and_Shoulders_Pattern_Jul_2020-01-d955fe7807714feea05f04d7f322dfaf.jpg)

How To Trade The Head And Shoulders Pattern

Tesla Stock Split Why Tesla Share Prices Will Get Cheaper Money

The Triple Bottom Candlestick Pattern Thinkmarkets Au

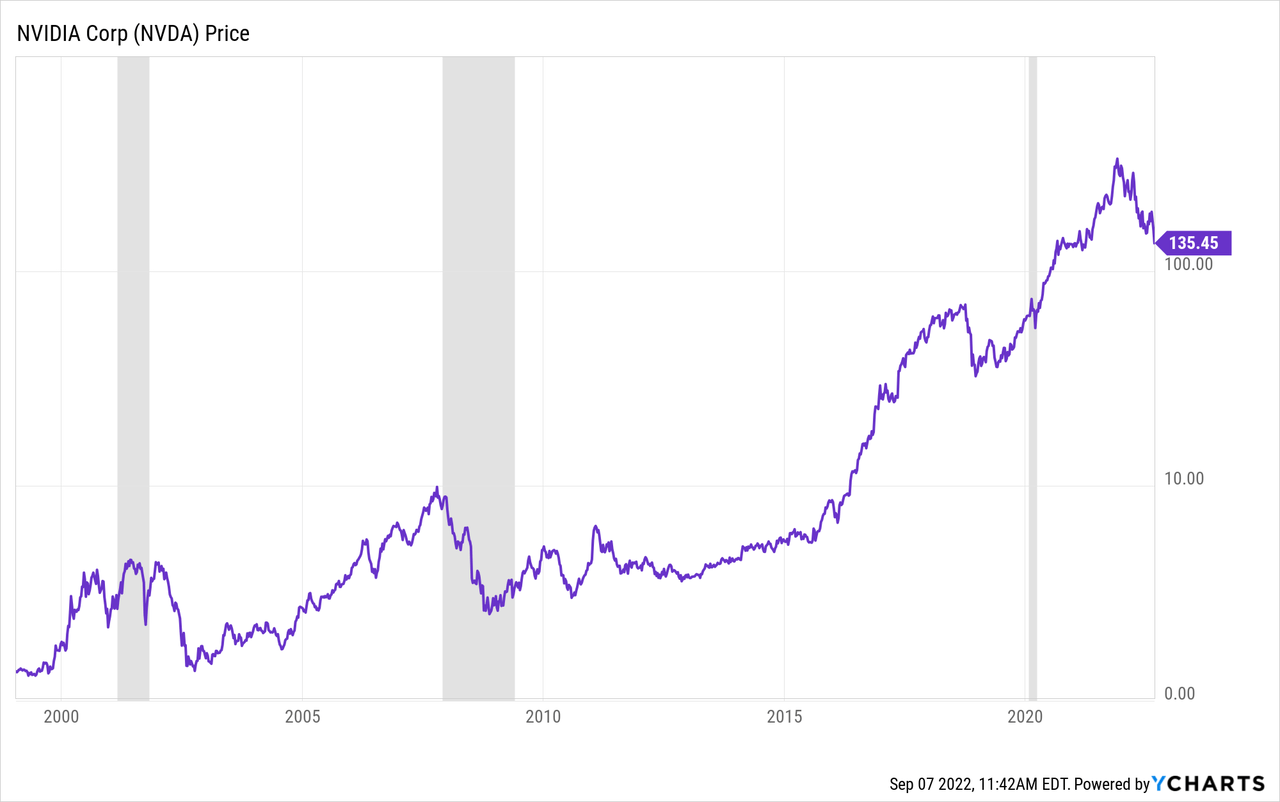

Here Is The Price I Ll Start Buying Nvidia Stock Nasdaq Nvda Seeking Alpha

What Is A Triple Bottom When Talking About Stocks Quora

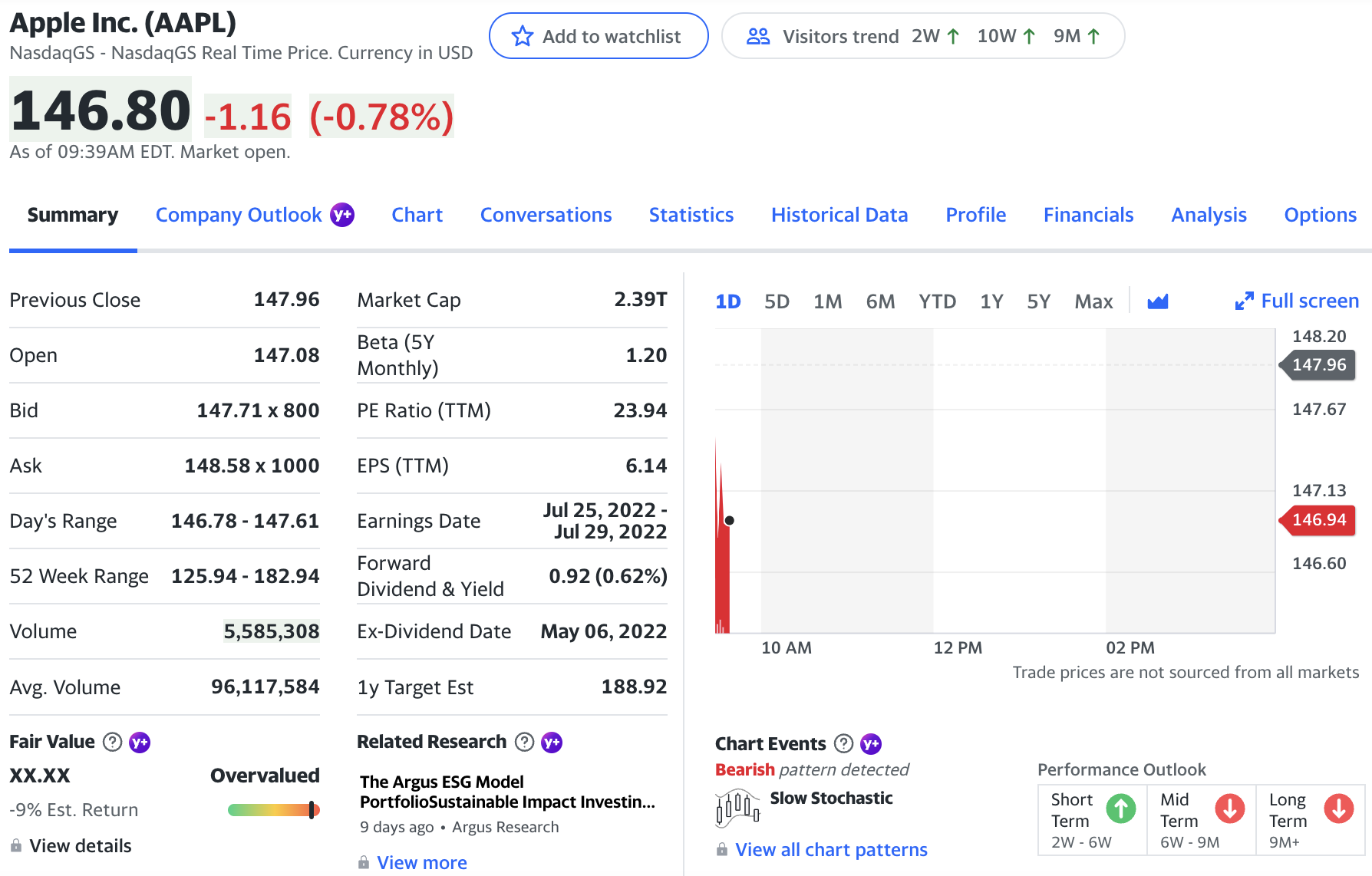

When Is The Best Time To Buy Stocks Forbes Advisor

These Stocks Were Our Best And Worst Performers In The Third Quarter

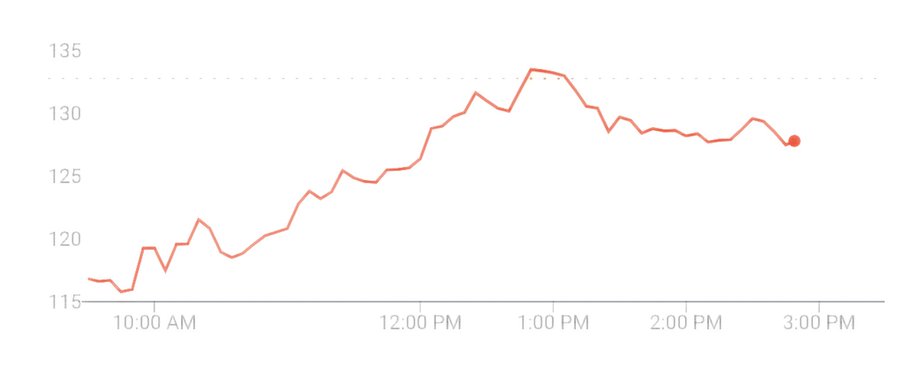

Investing For Beginners How To Read A Chart Moneyunder30

What Is A Triple Bottom When Talking About Stocks Quora

Gene Munster Predicts When Stock Market Could Hit A Bottom Spdr S P 500 Arca Spy Benzinga

Best Stocks For October 2022 Bankrate

10 Best Index Funds In October 2022 Bankrate

Charting Hockey Blackhawks Core Up Against Father Time The Athletic

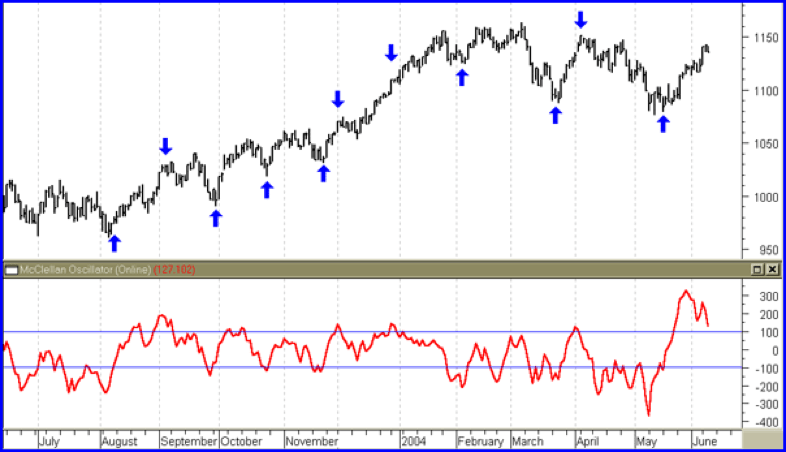

Technical Analysis Beginner S Guide To Technical Charts